Working with the FASTer Way To Fat Loss® coaching community has been absolutely incredible because of the diverse and insanely talented group of women with whom I’m privileged to work. They all bring something unique to the table, and getting to know them is one of the best parts of my job. One of these amazing coaches is Emily!

Emily Copeland is a FASTer Way To Fat Loss® certified coach, a busy mom of 4, and a sign language interpreter. Her mission is to empower women to take control of their health and wellness in order to create a healthy, sustainable lifestyle for themselves AND their families! In addition to coaching, Emily is a sign language interpreter and works for a local video relay company. She is a CODA (child of a deaf adult) and absolutely loves the deaf culture, so she is thrilled to bring coaching to hearing and deaf clients alike

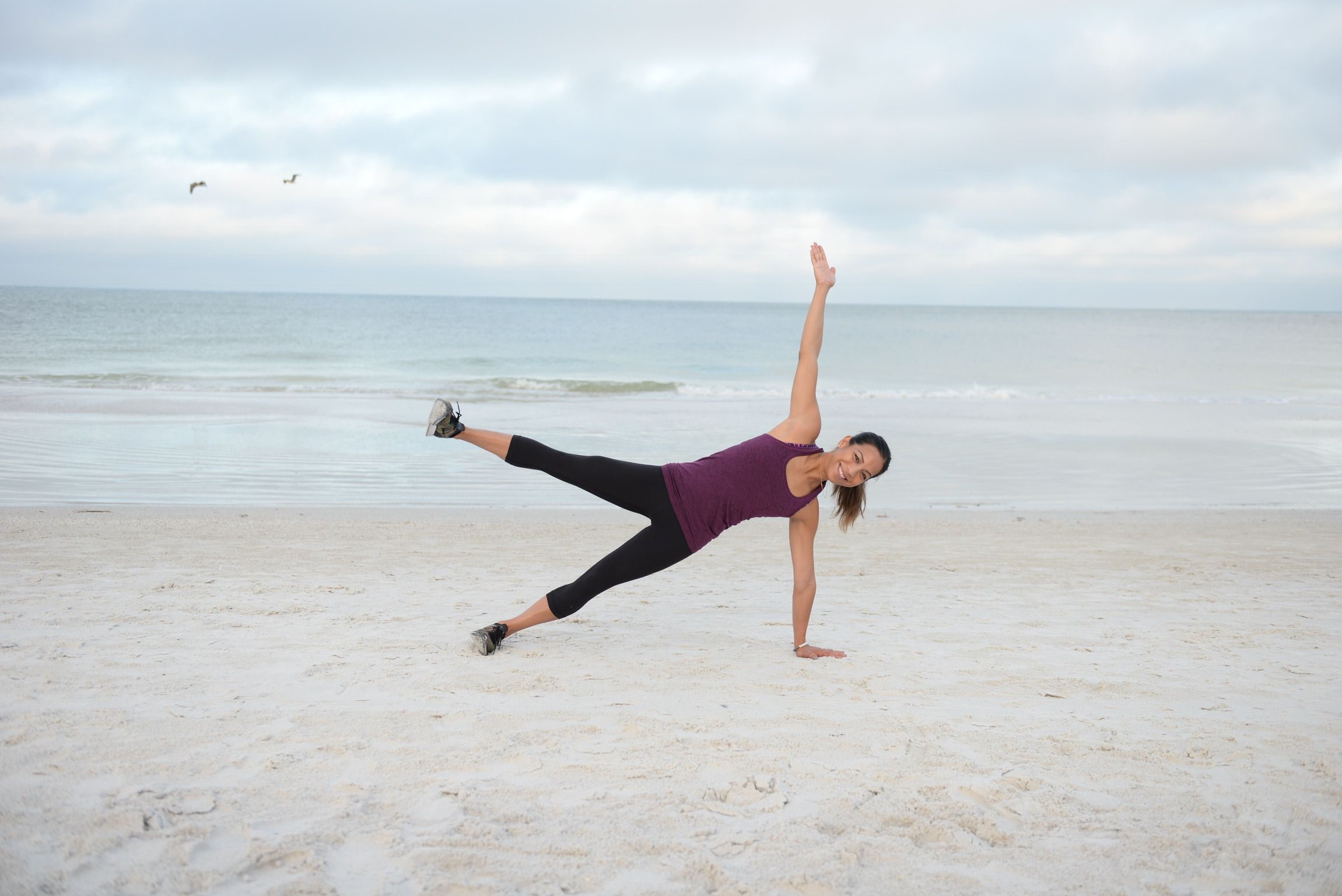

She loves working with women to help them lose weight, learn how to exercise properly, gain confidence, and transform their lives. Want to know more about how Emily helps women get fit? Be sure to grab her free guide 5 Ways to Find Your Abs!

Emily had to deal with some health issues last year that led her to strengthen her resolve to take better care of herself. She found the FASTer Way To Fat Loss® and was hooked after her first round. She did a second round, this time with her husband joining the men’s group, and the rest is history! She completed her coach certification and has been running FASTer Way groups ever since.

Emily told me, “Becoming a coach for the FASTer Way To Fat Loss® has transformed my life. Not only does it allow me to earn significant income for my family, but it allows me to share my passion for health and wellness. The coaching community is extremely supportive and the certification process left me feeling empowered to set big goals and then crush them! The FASTer Way has allowed my husband to pursue his own goals which will bring huge changes for us in 2018, but without the income from running my own groups, it would never have been possible!”

One of the most valuable things Emily gained from the FASTer Way was an understanding of what her “healthy” habits were doing to her. She was under-eating, over-exercising, and doing more harm than good in the process. She was able to gain sustainable nutrition strategies, a sustainable mindset, plus a better understanding of what real health is. The focus on non-scale victories has, “helped me to achieve things I would have never thought possible!”

One of my favorite parts of Emily’s story is what she has to say about the change in her income!

“I set some big goals for earning this year, but Q1 has already blown those out of the water. Being a FASTer Way Coach has given us the opportunity to make some career changes with confidence and security and allowed us to not only increase our income, but stop living month to month as well. We have been able to close our gaps towards financial freedom and look forward to what 2018 brings the rest of the year!”

Seeing women like Emily achieve big goals is the reason I get up every morning. Are you ready to change your life through coaching certification? The FASTer Way community is growing quickly, and if you’d like to apply to be considered for certification, get on the waitlist now!